Global sustainable mutual fund assets hit a record high at the end of the third quarter, bolstered by new disclosure rules in Europe, although the pace of net inflows slowed from the prior quarter.

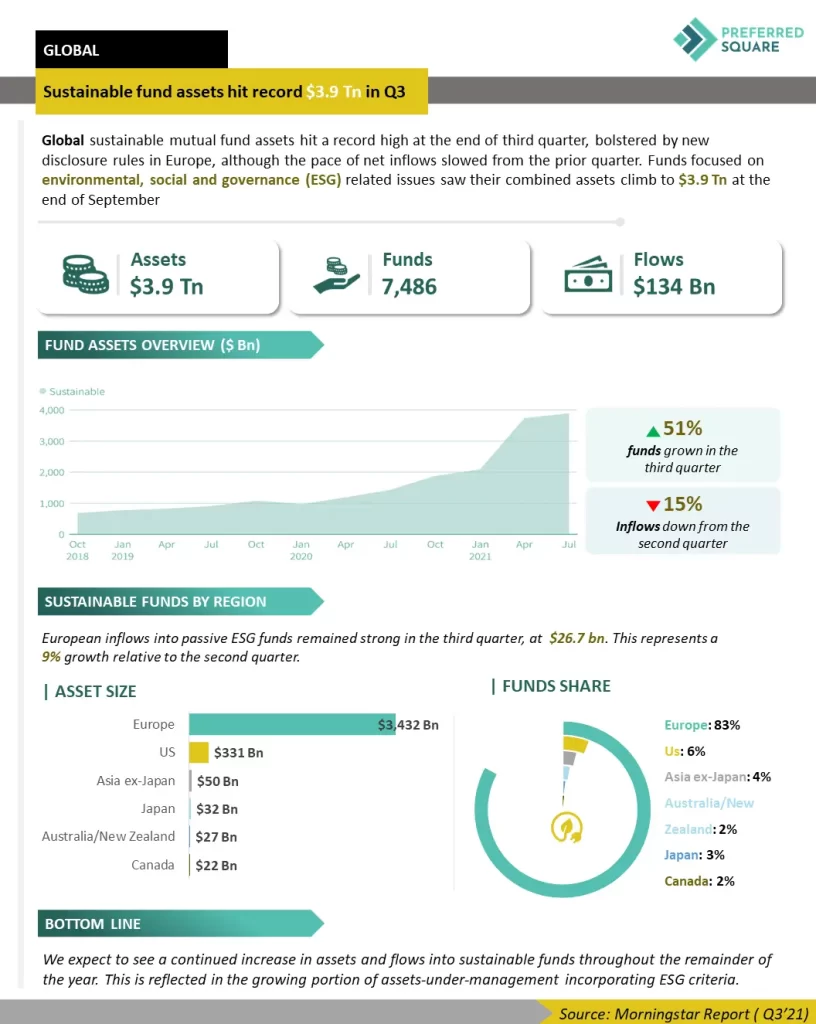

Funds focussed on environmental, social and governance (ESG) related issues saw their combined assets climb to $3.9 Trillion. The number of sustainable funds captured in Morningstar‘s global sustainable universe has grown by more than 51% over the third quarter, reaching 7,486 funds at the end of September.

Europe’s dominance of the sustainable fund space has increased as its ESG-focused universe expanded after the introduction of the Sustainable Finance Disclosure Regulation. The EU Sustainable Finance Disclosure Regulation (SFDR) is a set of EU rules which aim to make the sustainability profile of funds more comparable and better understood by end-investors. This will focus on pre-defined metrics for assessing the environmental, social and governance (ESG) outcomes of the investment process. All the new measures are in response to the landmark signing of the Paris Agreement in December 2015, and the United Nations 2030 Agenda for Sustainable Development earlier in 2015, which created the Sustainable Development Goals

The Sustainable Finance Disclosure Regulation aims to help drive $1.2 Trillion into green investments over the next decade, iron out the patchy climate-related information currently provided by financial market participants, and give firms with genuinely sustainable products an edge.

In the third quarter, Europe accounted for 81% of the quarter’s net inflows, while the United States accounted for 12%. Flows in the rest of the world clocked in at almost USD 10 Bn for Canada, Australia and New Zealand, Japan, and Asia combined.

We expect to see a continued increase in assets and flows into sustainable funds throughout the remainder of the year. This is reflected in the growing portion of assets-under-management incorporating ESG criteria.