Overview

Islamic finance is a financial system that operates according to the Sharia Law. Unlike traditional finance, it prohibits interest-based transactions and prioritizes ethical, asset-backed investments. The core principles of Islamic finance include risk-sharing, real economic activity, and the avoidance of speculative practices. By promoting fairness and transparency, Islamic finance aims to create a more inclusive financial system that benefits everyone involved.

Three fundamental principles that govern Islamic finance:

1. Principle of Equity (Prohibition of “RIBA” and “Gharar”):

-

Islamic finance strictly prohibits Riba (interest), which leads to unfair gains, and Gharar (excessive uncertainty or speculation), to ensure fairness, transparency, and ethical financial practices

2. Principle of Participation:

-

In Islamic finance, investors are encouraged to participate in opportunities where profits and risks are shared, promoting a more equitable and transparent financial system

3. Principle of Ownership/Asset-Backed Financing:

-

This principle ensures that all financial transactions are supported by tangible, real-world assets. By linking finances to actual economic activity, it protects property rights, upholds contract integrity, and supports the connection between the financial system and the real economy

Products

Islamic finance offers a diverse range of products designed to comply with Sharia principles. These products are categorized into three main types:

-

Profit-and-Loss Sharing Products (Mudarabah, Musharakah):

Partners share profits based on a pre-agreed ratio, while losses are borne according to capital contribution

-

Non-Profit-and-Loss Sharing Contracts (Murabaha, Istisna):

In Murabahah (cost-plus financing), the profit margin is disclosed upfront; Istisna is a sale transaction where the commodity is transacted before it comes into existence

-

Fee-Based Products (Ijarah):

A leasing contract where the lessee pays a fee to use an asset while ownership remains with the lessor

Evolution

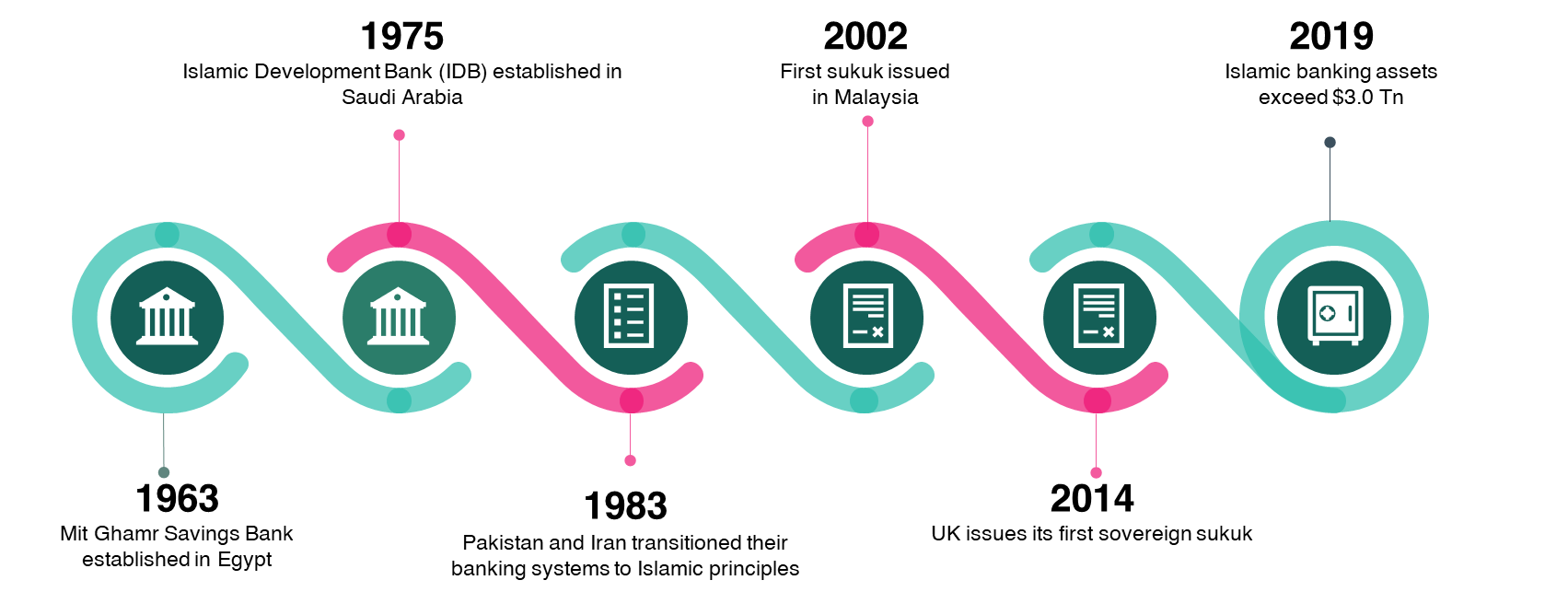

Islamic finance in banking started in 1963 with Egypt’s Mit Ghamr Savings Bank, establishing interest-free banking. While the concept was initially limited in scope, it gained momentum in 1975 with the establishment of the Islamic Development Bank (IDB) in Kingdom of Saudi Arabia. By 1983, Pakistan and Iran had fully transitioned to Islamic banking. The industry achieved global recognition in 2002 when Malaysia issued the first sukuk (Islamic bond). The turning point came in 2014, when the UK became the first Western nation to issue a sovereign sukuk, indicating global acceptance. By 2019, Islamic banking assets surpassed $3.0 Tn. What started as a niche financial experiment had evolved into a thriving global financial system.

Global Context

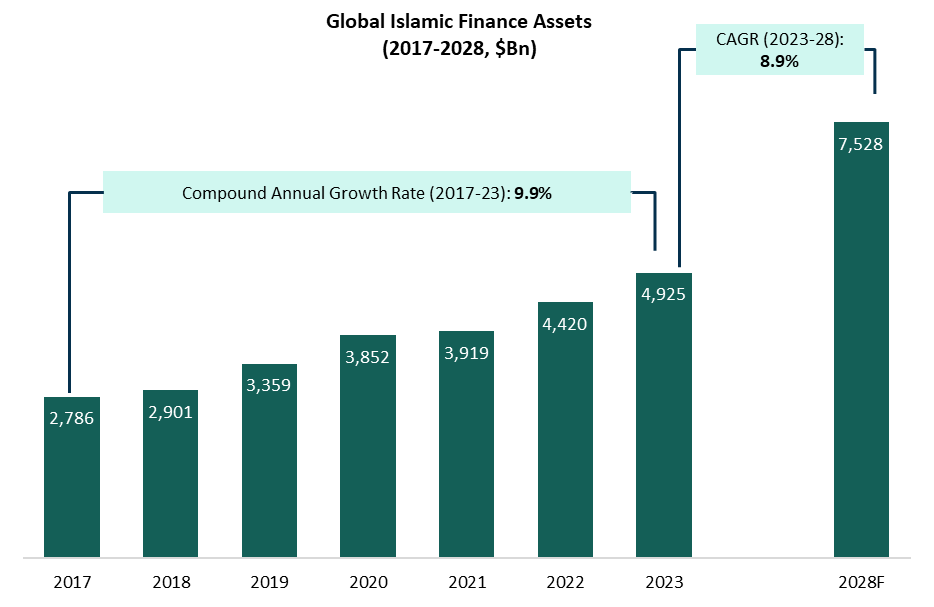

Islamic finance operates across ~80 countries, with key markets including Kingdom of Saudi Arabia, Iran, Malaysia, the UAE, Kuwait, and Qatar. Kingdom of Saudi Arabia and Iran lead the market, accounting for ~25-30% of global Islamic finance assets. The growth of Islamic finance has become a significant force in the global financial system. According to the LSEG Islamic Finance Development Report 2024, the total asset base historically increased from $2.8 Tn in 2017 to $4.9 Tn in 2023, registering a compound annual growth rate (CAGR) of 9.9%. It is projected to continue its upward trajectory, expected to reach $7.5 Tn in 2028, registering a CAGR of 8.9% (2023-28). The sector’s growth beyond its traditional markets in the Middle East and Southeast Asia highlights its increasing global appeal. Major international financial centers are witnessing an increase in Islamic finance activity, with global banks expanding their Sharia-compliant offerings to access Sharia-compliant capital. The industry’s commitment to ethical investment principles and its prohibition of interest-based transactions have influenced ESG-focused investors, indicating Islamic finance as a significant contributor to the global sustainable finance movement.

How is it different from Traditional Finance?

Importance in Kingdom of Saudi Arabia’s Landscape

Islamic finance plays a crucial role in Kingdom of Saudi Arabia’s economic landscape, specifically in supporting Vision 2030. This vision aims to diversify the economy, reduce dependence on oil, and promote sustainable development. Islamic finance contributes by providing Sharia-compliant funding for major national projects, including NEOM, the Red Sea Project, Qiddiya, etc. By adhering to ethical investment principles, the sector attracts socially responsible investors from both domestic and international markets. A key driver has been the issuance of sovereign Sukuk by the Saudi Arabian government, which has successfully mobilized capital for large-scale infrastructure projects. Additionally, Islamic finance enables financial inclusion by offering tailored products and services. Islamic microfinance and Takaful (Islamic insurance) have empowered small and medium-sized enterprises (SMEs) and low-income individuals to access essential financial services. This inclusivity aligns with Vision 2030’s objective of building a vibrant society and encouraging widespread economic participation. Also, the sector has attracted substantial foreign investment, particularly from Muslim-majority countries, which has supported Kingdom of Saudi Arabia’s broader economic development. The growth of Islamic finance has also generated employment opportunities, contributing to reduced unemployment rates and facilitating the country’s transition to a knowledge-based economy. In essence, Islamic finance serves as an important pillar in Kingdom of Saudi Arabia’s Vision 2030, driving economic diversification, fostering inclusive growth, and positioning Kingdom of Saudi Arabia as a global hub for Sharia-compliant financial services.

Regulatory Framework

The regulatory framework for Islamic finance in Kingdom of Saudi Arabia ensures compliance with Sharia principles while maintaining financial stability. The Saudi Central Bank (Saudi Arabian Monetary Authority or SAMA) oversees this framework through several key mechanisms:

-

Sharia Compliance:

Islamic financial institutions are required to adhere to Sharia law. Each institution appoints a dedicated Sharia board of qualified Islamic scholars to review, approve, and monitor financial products, ensuring they align with Islamic principles

-

Licensing and Supervision:

SAMA is responsible for licensing and supervising Islamic banks to ensure compliance with legal and regulatory standards. The Central Bank conducts regular audits and inspections, promoting transparency and ensuring the integrity of the financial system

-

Regulatory Guidelines:

SAMA issues guidelines covering essential aspects like capital adequacy, risk management, and corporate governance. These guidelines are designed to align with the best international practices while adhering to Sharia requirements

-

Product Approval:

Before introducing new financial products, institutions are required to seek approval from their Sharia board and SAMA. This dual review process ensures that all products comply with both Islamic principles and national regulatory standards

Success Stories

Islamic finance has been important in Kingdom of Saudi Arabia’s economic transformation, aligning with the Vision 2030. During the COVID-19 pandemic, Islamic banks demonstrated remarkable resilience, outperforming conventional banks and showcasing their stability during global economic uncertainty. Notable success stories include:

-

In 2017, Kingdom of Saudi Arabia’s Sovereign Sukuk Program raised $9.0 Billion for infrastructure projects, strengthening the leadership in Islamic finance

-

In 2021, Saudi Aramco’s $6.0 Billion Sukuk issuance highlighted investor confidence, while Alinma Bank launched a fully digital, Sharia-compliant banking platform, enhancing financial inclusion

-

In 2024, the funding of NEOM, through $1.3 Billion green Sukuk, attracted global investors focused on sustainable and Sharia-compliant opportunities

-

In 2024, the Red Sea Project, a luxury tourism initiative, secured $3.7 Billion in Sharia-compliant financing, generating jobs and boosting non-oil GDP

Challenges

Islamic finance in Kingdom of Saudi Arabia faces several challenges despite its growth:

-

Regulatory Complexities arise from the need to blend Sharia principles with global financial standards, and the lack of a unified regulatory framework across jurisdictions can hinder cross-border transactions

-

The rapid pace of Technological Advancement displays both opportunities and challenges, as integrating fintech solutions like blockchain and digital banking requires significant investment and expertise while ensuring Sharia compliance

-

The cost of ensuring Sharia compliance, including appointing Sharia boards and conducting audits, can be a barrier, especially for smaller institutions

-

The Sukuk market, while significant, faces liquidity constraints and limited secondary market activity

Way Going Forward

The outlook for the Islamic finance industry remains positive, driven by easing financial pressures on businesses and households, improved stock market performance, and lower yields on government securities. With US inflation hitting a three-year low in August 2024 and subsequent policy rate cuts by the US Federal Reserve, the global economic outlook is positive. This sentiment is evident in the rise of global Sukuk issuances, signaling continued investor confidence in Islamic finance. However, the industry faces potential risks from geopolitical tensions, trade fragmentation, and the impact of rising funding costs in conventional markets, which can influence investor sentiment and cross-border capital flows. Despite these risks, the industry is forecasted for substantial growth, with total global assets projected to increase from $4.9 Tn in 2023 to $7.5 Tn in 2028, registering a CAGR of 8.9%. By focusing on leveraging technology, fostering cross-border collaboration, promoting financial literacy, and aligning with global sustainability goals, the industry can continue its growth.

Leave a Reply