Introduction: A Landmark Moment in Economic Transformation

In January 2025, the Kingdom of Saudi Arabia introduced a landmark reform that marked a turning point in its economic liberalization agenda.

For the first time in the nation’s modern history, foreign investors were permitted to acquire up to 49% equity in real estate companies and Real Estate Investment Trusts (REITs) listed on the Saudi Stock Exchange (Tadawul), operating in Makkah and Madinah—two cities of immense spiritual, cultural, and geopolitical significance.

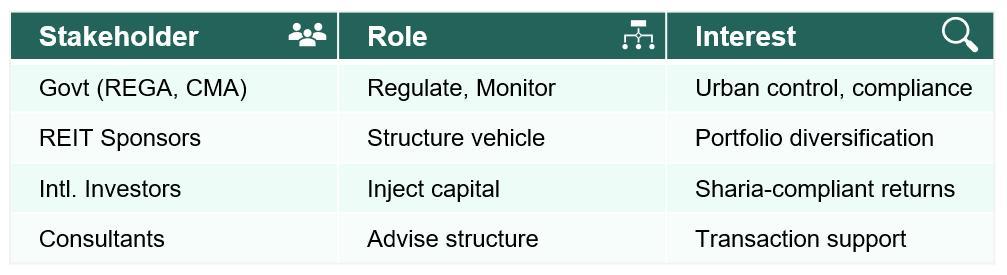

This move, spearheaded by the Capital Market Authority (CMA), is not merely a regulatory amendment. It is a bold signal of Saudi Arabia’s strategic intent to modernize capital markets, deepen foreign participation in real estate, and harmonize religious sensitivities with global investment frameworks. It complements the broader aspirations of Vision 2030 by diversifying the Kingdom’s economic base while preserving the sanctity of its holiest cities.

With the launch of Vision 2030 in 2016, Saudi Arabia initiated a wide-ranging economic transformation agenda aimed at reducing reliance on hydrocarbons, expanding the role of the private sector, and unlocking new investment streams. The 2025 reform represents a pivotal extension of this agenda, tailored specifically for two of the most symbolically important cities in the country.

Historical Context: A Long-Standing Restriction Lifted

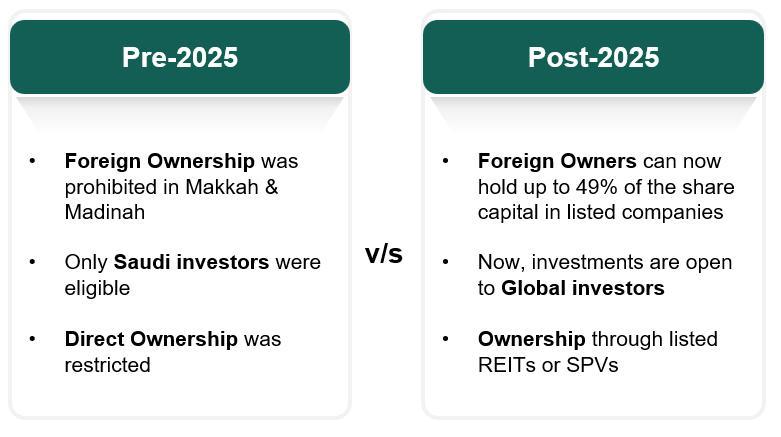

For decades, ownership of real estate assets in Makkah and Madinah was tightly controlled, with direct and indirect foreign ownership off-limits to non-GCC investors. This restriction stemmed from the religious sanctity of the two cities, coupled with concerns over cultural preservation and demographic integrity.

As a result, while the rest of Saudi Arabia underwent gradual liberalization such as the opening of the Tadawul stock exchange to Qualified Foreign Investors (QFIs) in 2015, while Makkah and Madinah remained investment enclaves limited to local or GCC capital. Institutional global investors were effectively excluded from participating in a sector defined by high occupancy rates, strong tourism fundamentals, and massive public-sector infrastructure investment.

This created an imbalance in capital availability for critical urban development in these cities. Despite increasing demand and large-scale government spending, foreign institutions had no structured entry route constraining innovation, sustainability upgrades, and asset-level operational efficiencies.

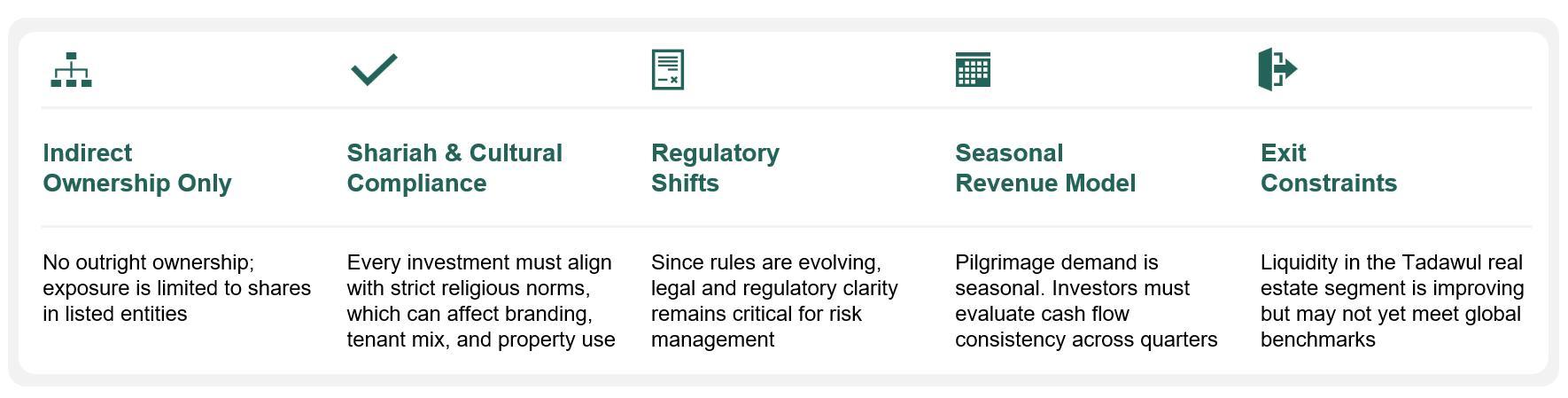

The January 2025 reform changes that dynamic. While direct asset acquisition by foreigners is still restricted, indirect participation through publicly listed companies and REITs is now permitted, subject to specific thresholds, compliance norms, and governance structures. This hybrid liberalization model opens new doors while preserving religious boundaries.

January 2025 Reform: Scope, Instruments, and Regulatory Boundaries

On January 3, 2025, the CMA released updated guidelines permitting non-GCC foreign investors to hold equity in listed real estate firms with operations in Makkah and Madinah. This reform builds on prior steps taken over the past decade, including:

- The opening of the Saudi REIT market (2016 onward)

- The introduction of real estate contribution funds

- The development of digital property platforms (Ejar, Sak)

- Increased transparency and disclosure norms in the real estate sector

Key Reform Provisions

- Ownership Cap: Foreign investors can now hold up to 49% of the share capital in eligible listed companies and REITs with exposure to Makkah and Madinah.

- Single Investor Threshold: No individual foreign investor may exceed a 10% stake without additional approvals.

- Investment Channels: Investments must be made via the Qualified Foreign Investor (QFI) route, mutual funds, or through capital market vehicles.

- Shariah Compliance: All real estate activities and structures remain subject to religious and legal compliance reviews, ensuring that investments align with Islamic principles and local sensitivities

This is not just a regulatory shift; it is a strategic liberalization measure that opens new avenues for value creation in an otherwise tightly held sector.

The Role of Makkah and Madinah in Saudi Arabia’s Economic Future

Makkah and Madinah are central to Saudi Arabia’s Vision 2030 goals—not just from a cultural standpoint, but as economic engines tied to religious tourism. Combined, these cities attract over 20 million pilgrims annually through Hajj and Umrah, a number the government aims to increase to 30 million by the end of the decade.

Why These Cities Matter Economically

Real estate markets in these cities are unique for several reasons:

- Cyclical Demand: Pilgrimage seasons guarantee annual visitation patterns, providing a stable demand base for hotels, transportation, retail, and healthcare services.

- Limited Supply of Prime Assets: Development is constrained by geography, regulations, and cultural considerations, which restrict overdevelopment and ensure sustained occupancy.

- State-Led Infrastructure Investment: Projects such as the Haramain High-Speed Railway, airport expansions, and urban renewal programs continue to enhance connectivity and capacity.

These factors combine to create one of the most resilient real estate demand profiles in the region, with potential for long-term, Shariah-aligned capital deployment.

Strategic Policy Objectives Behind the Reform

While the investment community has largely focused on what the reforms mean for foreign ownership, it is equally important to understand why the Saudi government enacted them. Several strategic goals underpin the CMA’s move:

-

Enhancing Capital Market Liquidity

By allowing foreign investors to access Makkah and Madinah indirectly, the Tadawul exchange gains new participants and deepens its investor base. This is in line with broader goals to increase market capitalization and align with international index requirements such as MSCI and FTSE.

-

De-Risking Public-Sector Funding

Much of the infrastructure development in these cities has traditionally relied on government funding. Private capital, particularly global capital, can now complement these efforts, reduce fiscal pressure while promoting risk-sharing.

-

Promoting ESG and Transparency

Listed companies are subject to disclosure, governance, and sustainability norms that improve the overall quality of real estate management in these sensitive locations. This helps ensure alignment with both investor expectations and societal values.

-

Facilitating Controlled Global Participation

By restricting exposure to listed vehicles and capping ownership percentages, the government retains strategic control while signaling openness. This enables gradual liberalization without compromising religious, political, or cultural objectives.

Understanding REIT Structures and Real Estate Capital Formation in Saudi Arabia

To fully appreciate the reform’s impact, it’s important to understand how capital is structured in the Saudi real estate sector.

Saudi REITs operate under strict dividend distribution requirements (typically 90% of net profits) and invest primarily in income-producing properties. The new reform allows foreign capital to enter via these REITs, gaining exposure to rental income, capital appreciation, and tourism-driven yield growth.

Equity ownership in listed developers also allows exposure to land banks, mixed-use developments, and phased project portfolios. These listed firms may hold:

- Long-term land leases near the Haram precincts

- Strategic urban renewal rights

- Hospitality, healthcare, and logistics assets linked to religious tourism flows.

Thus, indirect ownership becomes a proxy for diversified, low-volatility real estate yield tied to a highly specific user demographic.

Investment Themes and Opportunity Areas

Foreign investors looking to deploy capital into Makkah and Madinah’s real estate markets through public companies and REITs will find several compelling themes emerging.

-

Hospitality and Accommodation

The demand for pilgrim accommodation, especially during peak Hajj and Umrah periods continues to outpace supply. Mid-scale and extended-stay hotel segments are particularly underserved.

Investors can target REITs or development firms involved in:

- Hotel refurbishments and adaptive reuse projects

- Mixed-use hospitality hubs near key religious sites

- High-occupancy, Shariah-compliant accommodation models

-

Retail and Pilgrim Services

Retail offerings in the two cities are unique: they cater to short-duration, high-volume consumers. There is significant potential in structured retail centers, convenience-focused formats, and mixed-use developments tied to transportation hubs.

New transit-oriented developments (TODs), especially around the Haramain rail stations and expanded airports, offer strong investment propositions for retail-focused REITs.

-

Healthcare and Elderly Services

Many pilgrims are elderly and require medical attention. Yet healthcare infrastructure tailored to this demographic remains limited.

Foreign capital can support listed operators in expanding:

- Clinics and mobile medical units near pilgrimage routes

- Long-term elder care facilities integrated into real estate portfolios

- Outpatient centers attached to hotels or residential towers

-

Infrastructure-Linked Developments

Projects such as airport expansions and new metro lines open the door to ancillary development offices, staff housing, logistics hubs catering to residents, workers, and visitors.

Listed firms holding land near these infrastructure corridors may present significant upside, especially those with plans for master-planned developments.

-

ESG-Focused PropTech Integration

Sustainability and smart infrastructure are gaining importance in Saudi Arabia. Digital asset management, crowd control systems, and real-time energy tracking can enhance asset value while supporting ESG goals.

REITs and listed developers are increasingly integrating these tools into their portfolios, creating an opportunity for foreign investors with experience in smart city technologies.

Challenges and Risk Considerations

Despite the opportunities, this market remains complex and requires careful navigation. Key risks include:

Looking Ahead: A New Phase of Faith-Aligned Investment

The CMA’s January 2025 reform is both symbolic and material. It introduces a new chapter in Saudi Arabia’s economic diversification, one that carefully balances tradition with innovation. Makkah and Madinah are no longer investment blind spots—they are emerging frontiers for global capital, governed by unique rules but offering strong fundamentals and long-term upside.

This reform will likely catalyze further product innovation, including:

- Thematic REITs focused solely on religious tourism assets

- Joint ventures between listed Saudi firms and foreign asset managers

- Shariah-compliant Sukuk linked to religious city development

- Digital real estate investment platforms targeting international retail investors

As Vision 2030 progresses, the alignment between faith, finance, and foreign participation will continue to evolve.

For investors willing to understand the cultural terrain and operate with respect and patience, Makkah and Madinah offer not just returns—but reputational value and long-term strategic alignment with one of the world’s most ambitious transformation agendas.

Conclusion

Saudi Arabia’s 2025 foreign ownership reform marks a transformative chapter in the Kingdom’s urban and economic narrative. By opening Makkah and Madinah to global capital, the Kingdom is inviting the world to participate in its most sacred spaces—not just as pilgrims, but as co-investors in a shared future.

The reform is more than a real estate policy—it is a strategic lever that integrates heritage with innovation, local stewardship with global participation, and religious sanctity with sustainable urbanism. For investors and policymakers alike, it offers not only access to prime real estate, but also a front-row seat in the reimagining of two of Islam’s most cherished cities.

Moreover, the reform serves as a tangible expression of Saudi Arabia’s confidence in its institutional maturity and regulatory readiness. By embedding global best practices within a localized cultural framework, the Kingdom is signaling to the world that it can serve as a unique model of value-driven urban globalization. This pivot will likely attract a new class of investors, who seek not only financial returns but also purpose-aligned impact.

As the transformation gains pace, the spotlight will be on implementation fidelity, stakeholder coordination, and inclusive growth. Ensuring that the benefits of foreign investment are equitably distributed—through job creation, SME engagement, and urban accessibility—will determine the true success of this initiative. Ultimately, the 2025 reform could be remembered as the moment Saudi Arabia translated its spiritual capital into strategic capital, building a bridge between the divine and the dynamic, the historic and the future-forward.

Leave a Reply