Introduction: The Evolution of SaaS and its investor appeal

The Software-as-a-Service (SaaS) model has revolutionized the delivery and consumption of software, shifting the paradigm from perpetual licensing to recurring subscriptions. This transition has reshaped the enterprise software landscape, enabling rapid scalability, predictable revenue streams, and global reach. This has also drawn intense interest from investors in the past decade. In addition to the evident boom in technology and AI landscape SaaS companies represent an attractive asset class characterized by high growth rates, defensible business models, and operational leverage. By 2024, SaaS M&A reached record levels – one study counted 2,107 SaaS-related deals that year – the second-highest annual total ever – as companies and investors rushed to capitalise on cloud-based business models (SEG 2025).

However, there is other side of the coin as well – As attractive the asset class might be, the complexity and dynamism of SaaS businesses demand rigorous due diligence and analysis to separate signal from noise and ensure sound investment decisions. In recent years, competition for SaaS deals has intensified, driving up valuations and compressing diligence timelines. Additionally, the metrics / data points that defined SaaS companies differ from a normal business. Investors must adopt a systematic, analytical approach to their investment strategy and diligence – combining robust frameworks and granular metrics (Cherry Bekaert – Private Equity Report).

The article outlines the rapid evolution of the SaaS business model and its growing appeal to private equity (PE) investors. It highlights the shift to recurring revenue, strong unit economics, high margins, and scalability as core reasons for PE interest. PE firms favour SaaS companies for predictable cash flows, low churn, and the ability to meet the Rule of 40, while also emphasising the importance of rigorous due diligence and analysis due to heightened competition and rising valuations in the sector.

Why private equity loves SaaS: The core investment rationale

PE investors prize SaaS businesses for predictable recurring revenues and strong unit economics. Unlike one-time license models, SaaS companies bill customers on subscription, creating Annual Recurring Revenue (ARR) streams that are highly visible and sticky. High customer retention in other words – low churn, means renewals and expansion revenue are relatively assured. “Annual recurring revenue SaaS companies shine as a beacon of stability,” notes Sean Geoghan, Partner at Cherry Bekaert (Cherry Bekaert – Private Equity Report). In practice, PE firms focus primarily on key technical metrics in SaaS targets namely:

-

Recurring revenue & retention:

PE buyers want stable, growing ARR/MRR. Key metrics

include Net Revenue Retention (NRR) (the % of existing revenue retained plus upsell)

and Gross Retention (Phoenix Strategy). PE firms typically look for high NRR (typically

>100–110%) and low churn, which indicate predictable cash flow implying sticky

customer base which further translates into durable growth and de-risks the

investment. -

Profitability (Rule of 40):

Investors balance growth against profitability. The famous Rule of 40 posits that revenue growth rate plus EBITDA margin should exceed 40%. Boston Consulting Group too emphasizes this rule saying, “by adding together annual revenue growth and EBITDA margin, the Rule of 40 is a key metric for assessing financial performance” (BCG). Therefore, PE buyers often target SaaS firms that either grow rapidly (high growth offsetting lower margins) or deliver strong margins even with slower growth. Meeting the Rule of 40 signals a healthy, scalable business.

-

High margins and scalability:

SaaS business model inherently enjoy high gross margins (often 70–80% after hosting costs) and relatively low incremental capital expenditure primarily due to relatively low cost of goods sold (COGS) (Cherry Bekaert – Private Equity Report). Software solutions can scale to new customers (even enterprise clients) without proportional increases in costs. Cherry Bekaert observes that SaaS companies can “sustain high profit margins and operate with relatively low capital expenditure,” which makes them resilient even in tough markets (Cherry Bekaert – Private Equity Report). In short, high growth potential combined with strong gross margins creates a large addressable value with minimal reinvestment, an ideal profile for PE value creation.

-

Strong unit economics:

To ensure growth is sustainable, PE investors analyse unit economics such as Customer Acquisition Cost (CAC), Lifetime Value (LTV) and the LTV to-CAC ratio to ensure growth is sustainable. A healthy LTV/CAC ratio indicates that the business can grow without burning cash on marketing and sales (Phoenix Strategy). Firms that achieve organic customer acquisitions help ensure that PE’s capital yields strong returns.

In summary, PE firms evaluate SaaS targets through a financial lens: stable recurring revenue, efficient growth, and improving EBITDA margins are hallmarks of an investible SaaS business. By focusing on these metrics (and ensuring management can execute on them), PE sponsors can underwrite deals with confidence in the long-term cash flows.

Private equity playbooks: Key investment strategies in SaaS

A clear investment thesis is foundational for any Private Equity. SaaS investment theses typically fall into several archetypes, each with distinct objectives and risk profiles. The table below outlines the major types of SaaS investment theses and their core focus areas.

-

Buyouts of mature platforms (LBOs / Majority control acquisitions):

This is a classic case of a private equity acquisition – a PE firm buys a controlling stake of a SaaS company. With majority ownership, the PE firm has the authority to make changes across the acquired company – replacing or re-aligning management, altering strategy, implementing cost efficiencies, and pursuing inorganic growth, among others. They ideally would also have one of their members (or more) on the board of the acquired company.

Large PE funds like Silver Lake, Vista Equity, or Thoma Bravo often pursue leveraged buyouts of well-established SaaS platforms. These platforms typically have tens or hundreds of millions in ARR, strong management, and clear market positions. The PE sponsor provides capital (often heavily leveraged, hence, leveraged buyout) to fully buy out existing investors and founders. Afterwards, the firm may invest further to expand into new verticals or geographies, while driving operational improvements. Notable examples include Vista/Blackstone’s $8.4B buyout of Smartsheet and Thoma Bravo’s $5.3B acquisition of Darktrace in 2024 (Cherry Bekaert – Private Equity Report). Such “mega-deals” reflect confidence in SaaS at scale.

-

Growth stage minority investing:

Many PE investors (including growth equity firms like Insight Partners, TCV, or Summit Partners) take minority stake in fast-growing SaaS companies. Unlike a buyout, the PE firm does not assume the control of the company, but management and founders continue to run the company’s day-to-day operations – PE firms just act as a partner. This is especially common in later-stage growth rounds where PE provides capital for expansion and may eventually complete a buyout or IPO later. The typical profile of a target company would look like fast-growing SaaS providers often with high double-digit or triple-digit annual growth. They might be EBITDA-negative (reinvesting for growth) but have a proven business model with high gross margins and scalable unit economics.

At times, even buyout firms start with a minority investment and build a platform for tuck-in acquisitions. In either case, these investors target high organic growth where the aim is to look for innovative SaaS firms with proven product-market fit, often in niche verticals or emerging tech (e.g. AI-enabled cloud tools) and helping them expand to get a profitable exit either through a buyout or an IPO. Notable examples include Summit Partners’ minority growth equity investment in Keeper Security (cybersecurity SaaS) in 2023 – Summit Partners took a significant minority stake and joined the board to help fuel product innovation and global expansion (Insight Partners).

-

Platform roll-ups (Buy and build strategy):

Now here the PE firm does not buy a single company but uses an initial acquisition (the lead company) as a “platform” and then acquires multiple smaller complementary companies (“tuck-ins”) in the same space to accelerate growth or broaden the platform’s functionality. For example, a PE platform might first acquire a CRM tool and then bolt on a marketing automation vendor and an analytics startup to create a more comprehensive suite. This consolidation strategy leverages cross-selling and cost synergies. In fact, add-on acquisitions now dominate PE deal flow: one report found that since 2022, 74% of US PE buyout deals were add-ons, a modest decline from 2022 (80%) but still significant.

Additionally, this somewhere also highlights why most PE-backed SaaS deals are mid

market: smaller targets (often <50 employees) typically act as add-ons to larger, more mainstream platforms. Aventis Advisors notes 60% of SaaS acquisition targets had under 50 staff, indicating PE focus on nimble companies with innovative technology rather than gigantic incumbents (Aventis Advisors).

PE firms will choose one of the above strategies based on the target company’s stage and the investors’ objectives. Each approach has trade-offs in terms of risk, reward, and effort. For a PE firm looking to deploy capital in high-growth opportunities without taking over, a minority growth investment can yield excellent returns if the company goes for an IPO. If the goal is to unlock value in an under-optimized SaaS business and have full control, a leveraged buyout offers maximum influence and the levers of operational improvement and financial engineering. And if PE finds that a sector is ripe for consolidation, a platform roll-up can create a powerhouse where previously there were dozens of subscale players.

The metrics that matter: Quantitative and qualitative evaluation of SaaS targets

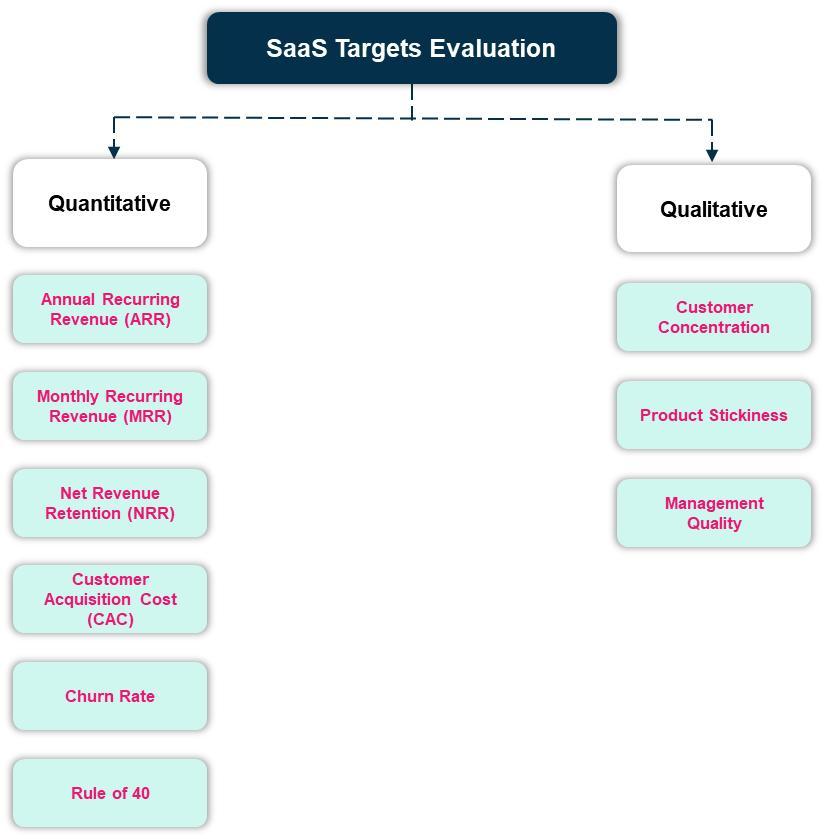

Quantitative

-

Annual recurring revenue (ARR):

ARR represents the total value of recurring subscription contracts normalized to one year. It’s the one of the most critical metrics for SaaS because it reflects predictable revenue streams of the company. For example, if a company has 1,000 customers paying $1,000 per month, its ARR is $12 million. PE firms look for strong ARR growth because it signals scalability and market traction. A SaaS business with $50M ARR growing at 40% annually is far more attractive than one with $50M ARR growing at 10%, even if both are profitable.

-

Monthly recurring revenue (MRR):

MRR is ARR measured monthly. It helps investors track short-term trends and seasonality. For instance, if MRR is $1 million, ARR would be $12 million. Consistent MRR growth indicates stability, while sudden drops can be a red flag for churn or customer dissatisfaction in the short term.

-

Net revenue retention (NRR):

NRR measures how much revenue is retained from existing customers after accounting for churn, upsells, and downsells. If a company starts with $1M ARR, upsells $200K, and loses $100K to churn, NRR is 110%. PE firms prefer NRR above 100% because it means customers spend more over time, reducing reliance on new sales in case of any sudden churns.

-

Customer acquisition cost (CAC):

CAC measures how much it costs to acquire a new customer. If a company spends $100,000 on marketing and gains 100 customers, CAC is $1,000 per customer. PE firms compare CAC to LTV (Lifetime Value) to ensure acquisition is profitable. A healthy SaaS business usually has an LTV:CAC ratio of at least 3:1.

-

Churn rate:

Churn is the percentage of customers or revenue lost in a period. High churn negatively impacts growth because it implies that the company is losing customers. For example, losing 10 customers out of 200 is a 5% churn rate.

-

Rule of 40:

This is a quick health check combining growth and profitability: growth rate + EBITDA margin should be at least 40%. For example, if a company grows 30% annually and has a 15% EBITDA margin, its Rule of 40 score is 45%, which is considered

strong.

Qualitative

-

Customer concentration:

PE firms assess whether revenue is spread across many customers or concentrated in a few – this helps assess riskiness of the customer profile. If the top three customers account for 50% of revenue, that’s risky because losing one could severely impact ARR. Ideally, no single customer should represent more than 10–15% of revenue.

-

Product stickiness:

There are specific metrics like Daily Active Users (DAU), Monthly Active Users (MAU), and feature adoption show how deeply customers rely on the product. High engagement means low churn and strong pricing power. For example, if 80% of users log in daily to the SaaS platform, that’s a sign of strong stickiness.

-

Management quality:

This is one of the most important and easily overlooked aspect of valuating a potential target. The experience and capability of the leadership team are critical. A high-quality management team is highly likely to make SaaS outlook a success.

Conclusion

In conclusion, the evolution of the SaaS model has fundamentally reshaped the software industry and transformed the way investors approach technology assets. SaaS businesses stand out for their predictable recurring revenues, operational scalability, and robust unit economics, all of which make them highly attractive to private equity investors seeking both growth and stability. However, as the sector matures and competition intensifies, distinguishing between promising opportunities and potential pitfalls requires far more than surface-level analysis. Rigorous diligence – encompassing both granular quantitative metrics like ARR, NRR, and the Rule of 40, as well as qualitative factors such as management calibre and product stickiness – is essential for effective investment decisions.

Private equity firms must adopt systematic frameworks that balance disciplined financial scrutiny with a clear strategic vision, whether pursuing majority buyouts, minority growth investments, or platform roll-ups. Ultimately, those who succeed in the SaaS arena are not only able to interpret the data but also anticipate market shifts and operational challenges. As SaaS continues to drive innovation and disrupt traditional business models, disciplined and insightful investors will be best positioned to unlock lasting value and help shape the future leaders of the software industry.

Leave a Reply