Executive summary

Saudi Arabia’s real estate sector is moving into a new normal for the cost of capital. For investors, this is journey from years of affordable money, through a period of sharp tightening, to more balanced but structurally more expensive capital landscape.

Before 2020, global interest rates were at historic lows, liquidity was abundant, and leverage was inexpensive. Developers and investors thrived in this environment, with lower WACC, enabling ambitious projects and elevated equity returns. This period created a sense of inevitability around growth, particularly as Vision 2030 mega-projects drove demand across residential, commercial, and hospitality segments.

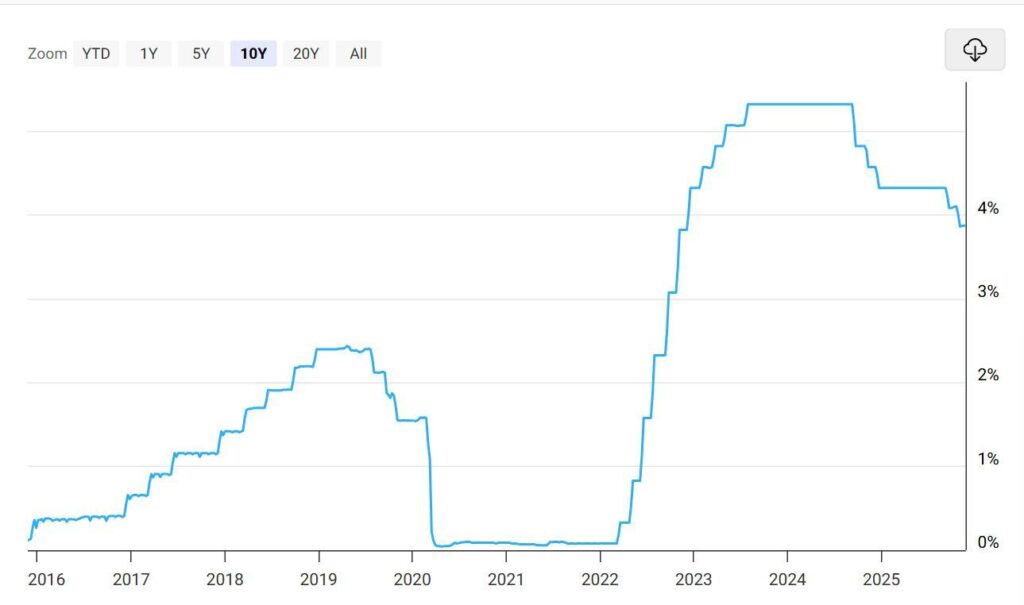

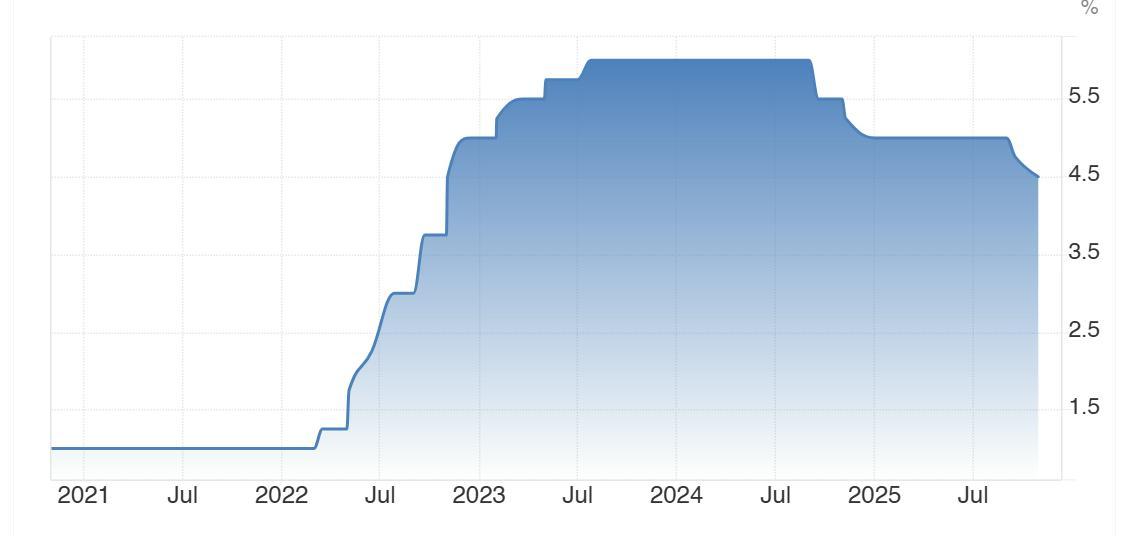

The landscape changed dramatically in 2022 and 2023. Inflation surged to multi-decade highs, prompting the U.S. Federal Reserve to embark on its fastest tightening cycle since the 1980s. With the Saudi riyal pegged to the U.S. dollar, domestic financing conditions tightened in lockstep.

Results were such that borrowing costs rose sharply, construction inflation eroded margins, and investors faced a new reality: WACC estimates across GCC real estate firms climbed toward 8-10% for the PIF backed developers like BDC and ROSHN, and for other developers like Tatweer and Saudi Real Estate SJSC in the range of 9-12.5%, depending on capital structure and cost of debt.

In the contemporary times (2025), the sector has begun to stabilize. Global inflation is moderating, central banks are pivoting toward easing, and the Saudi Central Bank (SAMA) lowered its repo rate to 4.5% in October 2025 (SPA, SAMA). Yet this easing does not signal a return to the pre-2021 levels when repo-rate hovered near 1.0%. For investors, this represents a new baseline: financing is more balanced, but structurally elevated, requiring disciplined underwriting, realistic yield expectations, and a focus on stabilized cashflows rather than speculative growth.

Introduction: Navigating capital cost normalization in Saudi real estate

Saudi Arabia’s real estate market has expanded rapidly in the past decade. Population growth, economic diversification, tourism initiatives, and mega projects Diriyah, King Salman Park, Jeddah Central, and King Salman International Airport stand out as successful developments that are reshaping Riyadh and Jeddah, delivering tangible progress and attracting global investor interest (Globeswire, Knightfrank).

During the period when the cost of debt and equity was comparatively low, developers relied heavily on leverage to accelerate growth. Financing structures benefited from accommodative benchmark rates, and lenders were willing to support ambitious expansion strategies. Domestic and international investors were drawn to the Kingdom’s compelling growth narrative, and valuations reflected optimistic assumptions regarding absorption, pricing, and exit yields.

After an initial sharp reduction in interest rates, financing conditions remained highly accommodative through 2021. However, between 2022 and 2023, the U.S. Federal Reserve initiated its fastest tightening cycle since the 1980s, raising policy rates from 0% to over 5% through 11 consecutive hikes. Inflation in advanced economies surged, peaking at 9.1% in the U.S. in June 2022, forcing monetary authorities to act decisively. Saudi Arabia, bound by its currency peg to the dollar, adjusted in parallel, resulting in a materially higher cost of capital across the real estate sector (Fed).

By 2024, inflationary pressures began to moderate, allowing interest rates to ease gradually. In 2025, policy rates stabilized around 4.5%, marking the emergence of a more balanced capital environment. While this represents a clear improvement compared to the peak tightening cycle, it does not signal a return to the historically low financing costs of the pre-2021 era.

For investors, this normalization fundamentally alters baseline assumptions for every project. Returns must be recalibrated, evaluated against structurally higher discount rates, scenario analysis under different assumptions, and capital deployed with greater discipline. Saudi Arabia’s real estate sector continues to offer substantial growth opportunities, but success now depends on navigating this new financial reality with sharper judgment, conservative underwriting, and a long-term perspective.

Cost-of-capital drivers

Several global and local factors have contributed to the cost of capital change in Saudi real estate.

-

Higher global benchmark rates:

The primary reason for the normalisation is the global interest rate environment. Since Saudi riyal is pegged to the U.S. dollar, Kingdom’s monetary policy had to move in parallel, transmitting higher borrowing costs directly into the domestic financial system. Even though Saudi inflation remained relatively contained to 2.0%-2.3% in 2025 (Trading Economics), local borrowing costs still rose sharply. Banks and corporations faced higher funding expenses, which translated directly into more expensive debt for developers and investors.

-

Global monetary tightening & elevated risk-free rates:

In the post-pandemic era, central banks globally have raised policy rates aggressively to combat inflation (Reuters). As global sovereign yields rise, the risk-free rate, a key input in discount-rate and capital-cost calculations has increased. For markets like Saudi Arabia, which are integrated into global capital flows, this rise in global yields translates into higher funding cost, higher equity returns expectations, and greater discipline in underwriting.

-

Increased risk premiums:

Real estate is a long-duration asset class, sensitive to changes in required returns. As global risk premiums increased due to macro uncertainty, geopolitical tensions and volatility in emerging markets, investors demanded higher expected returns. This elevated the cost of equity, influenced valuation multiples, and increased the sensitivity of feasibility models to discount rate changes. A 2025 report on GCC construction & real-estate firms estimated median WACC around 9–10% (RBSA Advisors GCC Report).

-

Bank lending dynamics and vision 2030 allocation:

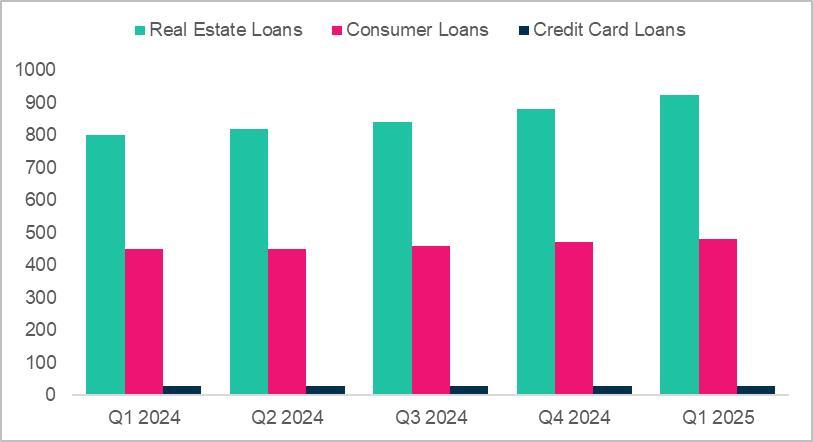

Real estate continues to be a major exposure for Saudi banks with outstanding real-estate loans reaching SAR 922.2 billion ($246 billion) as of Q1 2025 in the balance sheet, indicating demand for housing as well as high end real estate development projects (SAMA).

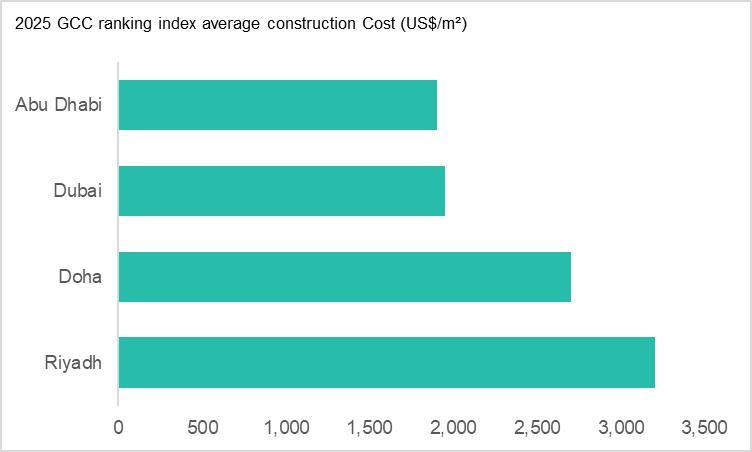

While liquidity in the banking system remains strong, a significant share of capital is increasingly channelled toward Vision 2030 giga-projects such as Qiddiya, Diriyah Gate, and Red Sea Global. These government-backed developments attract priority financing due to their scale, strategic importance, and perceived lower risk, creating intense competition for funding, contractors, materials, and skilled labour. As a result, private and mid-sized developers face higher construction costs, longer lead times, and reduced access to top-tier contractors, all of which indirectly elevate financing needs and increase return thresholds.

At the same time, banks have tightened underwriting standards as interest rates have risen and global volatility has increased. Coverage ratios, covenant requirements, loan-to-value thresholds, and pricing spreads have all become more stringent, making lenders more selective. Only projects with strong sponsors, robust fundamentals, and clear cashflow visibility can secure financing at competitive terms, while speculative or thinly capitalised projects face growing difficulty in accessing credit. This combination of Vision 2030-driven capital allocation and stricter bank risk management practices has materially increased the overall cost of capital for real estate developments in the Kingdom.

-

Inflationary pressure and construction cost escalation:

Globally, in 2020 non-residential construction inflation was 2.5%. In 2021 it jumped to 8%, the highest since 2006-2007. In 2022 it hit 12.8%, the highest since 1980-81. Residential construction cost inflation in 2020 it was 4.5%. In 2021 it jumped to 14% and then in 2022 reached 15.8% (Construction Inflation).

While global construction inflation has moderated from the extreme peaks of 2021–2022, costs remain structurally higher than pre-pandemic levels. The developers continue to face elevated input costs for steel, cement, and imported finishes.

Supply-chain resilience has improved yet financing models still need to account for persistent cost pressures. The environment has shifted from “hyper-

inflationary” to “structurally expensive,” meaning margins remain compressed even as volatility eases.

-

Evolving investor risk appetite:

As macroeconomic volatility persists, equity investors in Saudi real estate have become more cautious and demanding. Rising global benchmark rates and heightened uncertainty have shifted return expectations upward, with investors requiring stronger fundamentals before committing capital. This has structurally elevated the cost of equity across the sector.

Sponsors are now expected to inject more capital upfront, demonstrate resilient cashflows, and secure pre-sale or lease commitments to reduce risk. Valuation multiples have compressed, and feasibility models have become more sensitive to discount-rate changes.

Collectively, these drivers signify a structural elevation in the financial hurdle rate for real estate in Saudi Arabia.

Implications on investors:

The combined impact of rising benchmark rates, higher risk premiums, stricter bank underwriting, and competition from Vision 2030 giga-projects has materially increased required returns for investors in Saudi real estate. Debt has become more expensive and selective, pushing developers to rely on stronger equity cushions, phased financing, and more robust project fundamentals. Equity investors are now demanding higher IRRs, clearer cashflow visibility, and greater downside protection, while valuation multiples have compressed and feasibility models have become more sensitive to discount rates and cost assumptions.

As construction costs remain structurally elevated and liquidity is increasingly channelled toward large government-backed developments, private projects face sharper competition for both funding and execution capacity. Investors are placing greater emphasis on rigorous sensitivity analysis and scenario testing by stress-testing variables such as interest rates, construction inflation, absorption rates, and exit yields to ensure resilience under different market conditions. Overall, the environment has shifted toward disciplined capital deployment, favouring well-capitalised sponsors, strategically located assets, and projects that can withstand higher hurdle rates and tighter financing conditions.

Real-world signals: Market data reflect the reset

-

Repo rate trajectory (SAMA)

The Saudi Arabian Monetary Authority (SAMA) has mirrored the U.S. Federal Reserve’s tightening cycle due to the riyal’s dollar peg. Policy rates rose from 1.75% in May 2022 to a peak of 6.0% in July 2023, marking the sharpest increase in decades. Since late 2024, SAMA has cautiously eased, cutting the repo rate to 4.5% on October 29, 2025, the lowest in three years.

Yet even after this moderation, rates remain well above pre-pandemic levels (1.0% in March 2020). For investors, this trajectory signals that the era of affordable debt is over. Financing costs have reset structurally higher, and feasibility studies or returns analysis must now incorporate debt service at levels that were considered high.

-

Valuation multiples

Listed Saudi real estate firms provide another clear signal of the reset. Public market valuation multiples- revenue and EBITDA have compressed compared to pre-2020 benchmarks. Saudi developers are currently trading at EV/Revenue multiples of 3.1x-3.3x and EV/EBITDA multiples of 9.9x-10.4x, down from double-digit levels seen in 2018–2019. P/E ratios hover around 14.6x-23.1x, reflecting investor caution despite strong demand drivers such as Vision 2030 and giga-projects.

This reflects a structural repricing of risk. Equity investors now demand higher returns to compensate for macro volatility, financing costs, and construction inflation. Multiples have shifted downward, feasibility models are more sensitive to discount-rate changes, and sponsors must demonstrate stronger fundamentals to attract capital.

-

Market dynamics and price index movements

The Kingdom’s real estate price index rose 3.2% year-on-year in Q2 2025, signalling demand resilience even under tightened financing conditions (Stats.gov.in).Additionally, residential transaction data shows sustained volume: in H1 2025 alone, residential deals crossed SAR 77.5 billion, a modest increase over H1 2024. (Knight Frank AE).

However, the growth in prices and transaction volume coexists with rising cost of capital indicating that while demand remains, developers’ margin buffers are shrinking.

Strategic imperatives: How investors must adapt

For investors & equity providers

- Reset return expectations: Accept that high-growth, high-leverage models may no longer deliver previous IRR levels. Focus on stabilized cashflow, yield, and capital preservation.

- Demand more rigorous diligence: Cashflow modelling, sensitivity analyses, stress-testing under interest-rate and cost-inflation scenarios should become standard.

- Diversify across asset types and geographies: Mitigate risk exposure by not over-concentrating in speculative development or single markets across asset types including residential, commercial, retail, hospitality, etc.

- Prioritise high-quality, income-generating assets: Logistics, affordable housing, occupied residential rentals, core commercial real estate may offer more stable risk-adjusted returns under the new regime.

- Align with Vision 2030 Themes: Despite higher capital costs, giga-projects and national priorities continue to anchor demand. Investors who align with these themes benefit from policy tailwinds and institutional support.

Outlook: A gradual easing in financing conditions and a more balanced capital environment

As Saudi Arabia moves into late 2025 and early 2026, the cost-of-capital environment shows early signs of stabilisation- a shift driven by moderating global inflation and the Federal Reserve’s pivot toward monetary easing in the second half of 2025. Because the Saudi riyal is pegged to the U.S. dollar, the Kingdom’s monetary policy typically adjusts in tandem with the Fed. This alignment is already visible: In October 2025, SAMA lowered its benchmark repo rate by 25 bps to 4.50%, its lowest level since early 2022 (TradingEconomics).

This easing represents a meaningful shift compared to 2024, when policy rates remained at a multi-decade high of approx. 6.0%, creating a significantly tighter financial environment and elevating SAIBOR-linked borrowing costs across the real-estate sector.

The broader global backdrop reinforces this trend. The Fed’s own rate-cut cycle, initiated in September 2024 by 50 bps and ongoing recently till December 2025 (latest by 25 bps from 3.75% to 3.50%), has led to synchronized easing across GCC central banks, including SAMA and the UAE Central Bank (GCC Business Watch). This could gradually lower developers’ funding costs, soften discount-rate assumptions, and improve debt-service coverage ratios.

Saudi Arabia’s macroeconomic fundamentals supported by a strong fiscal position, steady non-oil GDP growth, and a robust investment pipeline under Vision 2030 further reduce risk premia. According to Jadwa Investment’s 2025 outlook, macro stability is expected to strengthen over the coming year (Jadwa Research).

If these dynamics persist, the sector may transition from a period of cost-pressure to one of cautious recovery. While financing will remain more expensive than in the pre-2021 era, the extreme tightening of 2022–2023 is expected to ease, allowing more projects to achieve feasibility, provided underwriting remains conservative, disciplined and scenario-based.

Leave a Reply