Introduction: The New Tariff-Driven Investment Landscape

In early 2025, the United States introduced a sweeping set of tariff measures that marked a turning point for global markets. New U.S. trade rules imposed 25% duties on most goods from Mexico and Canada and an additional 10% tariff on all imports from China, while ongoing investigations under the America First Trade Policy and Fair and Reciprocal Plan signaled potential extensions to Europe and Asia. With the average effective U.S. tariff rate now reaching 22.5%-the highest in more than a century-the investment environment entered a new phase of policy-driven disruption.

This shift represents more than a tactical adjustment in trade relations; it is a structural shock to how private capital navigates a deeply interconnected economy. The U.S. Economic Policy Uncertainty Index surged to record highs, reflecting widespread market anxiety over prolonged trade tensions, inflationary pressures, and monetary policy uncertainty. For real estate, this has meant delayed capital deployment, wider risk exposure, and more conservative underwriting. For private equity, tariff complexity is complicating exit conditions, with fund managers reassessing valuations, extending sale timelines, and restructuring portfolio strategies to manage supply chain exposure.

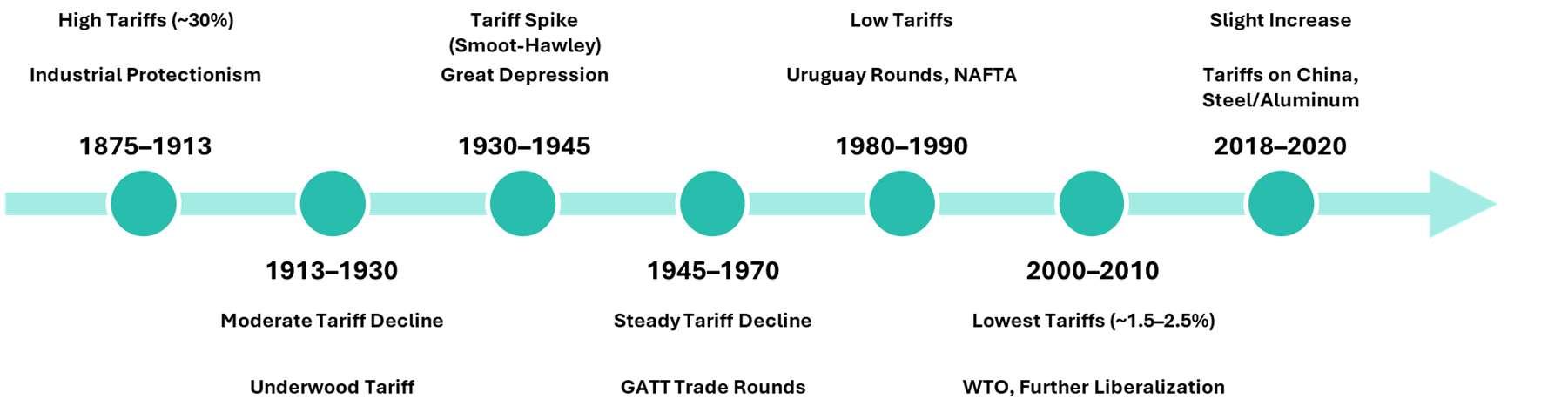

Historical Context: Tariff Policy Precedents and Market Response

The current tariff environment echoes elements of past U.S. protectionist periods, when shifts in trade policy significantly reshaped global markets. While today’s economy is more interconnected, making ripple effects more complex, the historical precedents provide valuable lessons for investors.

Historical Comparison Points:

- 1875–1913 Protectionist Peak: Tariffs averaged 30-50% as policies like the Morrill, McKinley, and Dingley Tariffs sought to protect U.S. industries. This period reflected a strategy of industrial development through trade barriers.

- 1913–1920s Liberalization: The Underwood Tariff Act reduced duties and expanded the list of untaxed goods, marking the first meaningful push toward freer trade and greater competitiveness for U.S. manufacturers.

- 1930s Smoot-Hawley Era: Duties on over 20,000 imports raised average tariffs to 45%. Instead of stabilizing the economy, the policy provoked retaliation from major partners and contributed to a 60% collapse in world trade by 1933.

- Post-WWII to 1970s Liberalization: Under the General Agreement on Tariffs and Trade (GATT) framework, successive negotiation rounds cut tariffs dramatically. By the 1970s, U.S. tariffs on industrial goods fell to 10% or lower, setting the foundation for global trade expansion.

- 1990s–2000s NAFTA & WTO Integration: With the North American Free Trade Agreement (NAFTA) and World Trade Organization (WTO) membership, the U.S. entered its most open trade era. By the 2010s, average tariffs were at historic lows of 1.5-2.5%, reflecting deep globalization and supply chain integration.

- 2018–2020 Strategic Protectionism: Tariffs targeting China and other countries with large trade surpluses signaled a return to selective protectionism, sparking retaliation and reshaping supply chains.

- 2025 Broad Tariff Regime: A 10% blanket tariff on all imports, with additional levies tied to bilateral deficits, marked the most sweeping trade shift in over a century. Persistent exemptions and reversals have heightened uncertainty, with global retaliation already underway.

Strategic Objective and Policy Intent

At the strategic level, the policy is designed to tilt the investment rationale of both MNC’s and institutional investors. For private equity and real estate markets, this translates into redirected capital flows toward domestic manufacturing, logistics, and infrastructure assets positioned to benefit from a localized production base. The tariffs aim to accelerate this pivot, encouraging fund managers to seek opportunities in sectors less exposed to global volatility while strengthening the resilience of U.S.-anchored portfolios.

However, this policy shift is not without trade-offs. While it offers the potential for revitalizing domestic industries and creating new areas of value creation, it also increases operational costs and injects volatility into global capital markets. The underlying policy intent therefore extends beyond short-term trade leverage-it is a structural signal to reposition private capital toward sectors and geographies aligned with national economic priorities.

Private Equity Sector Transformation

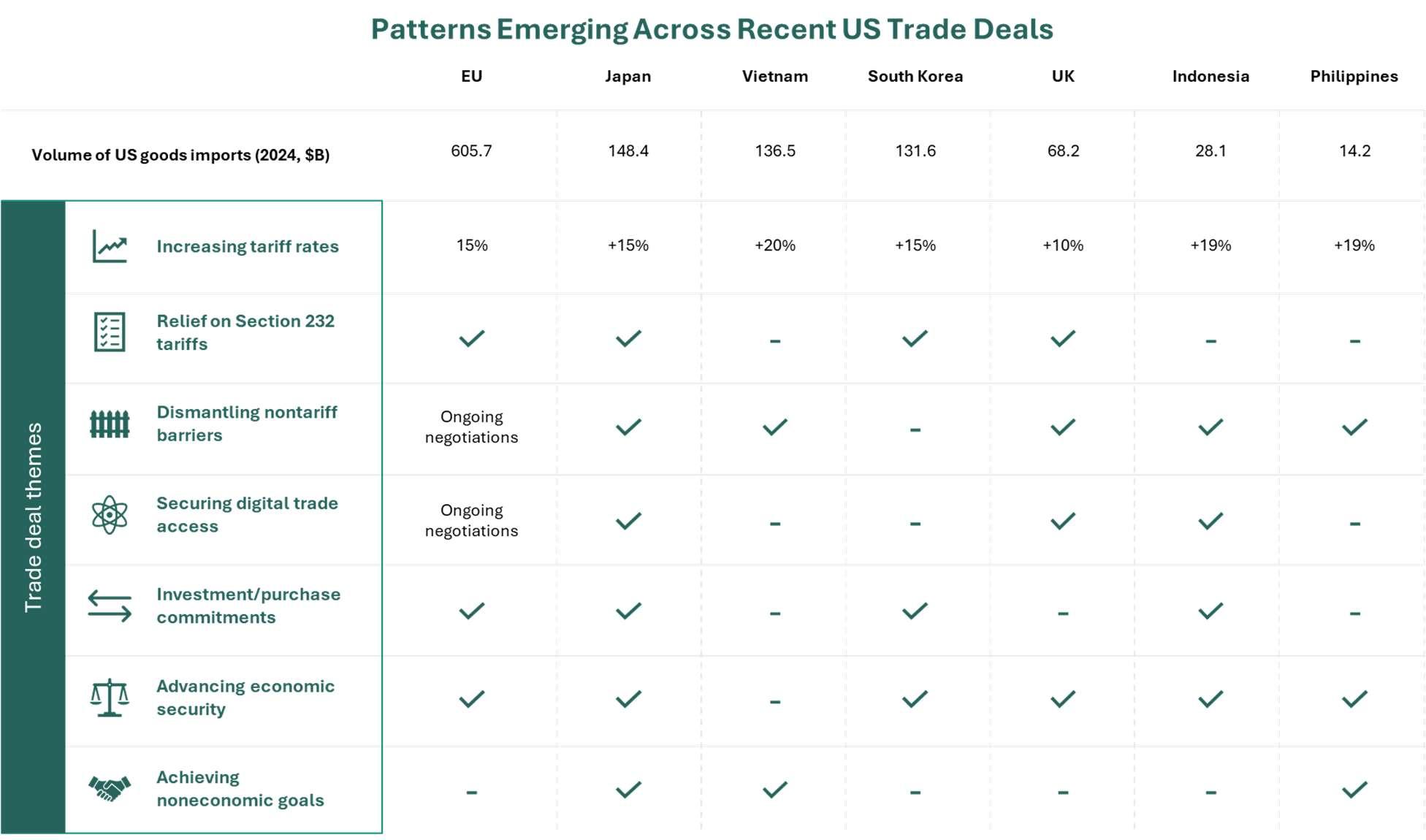

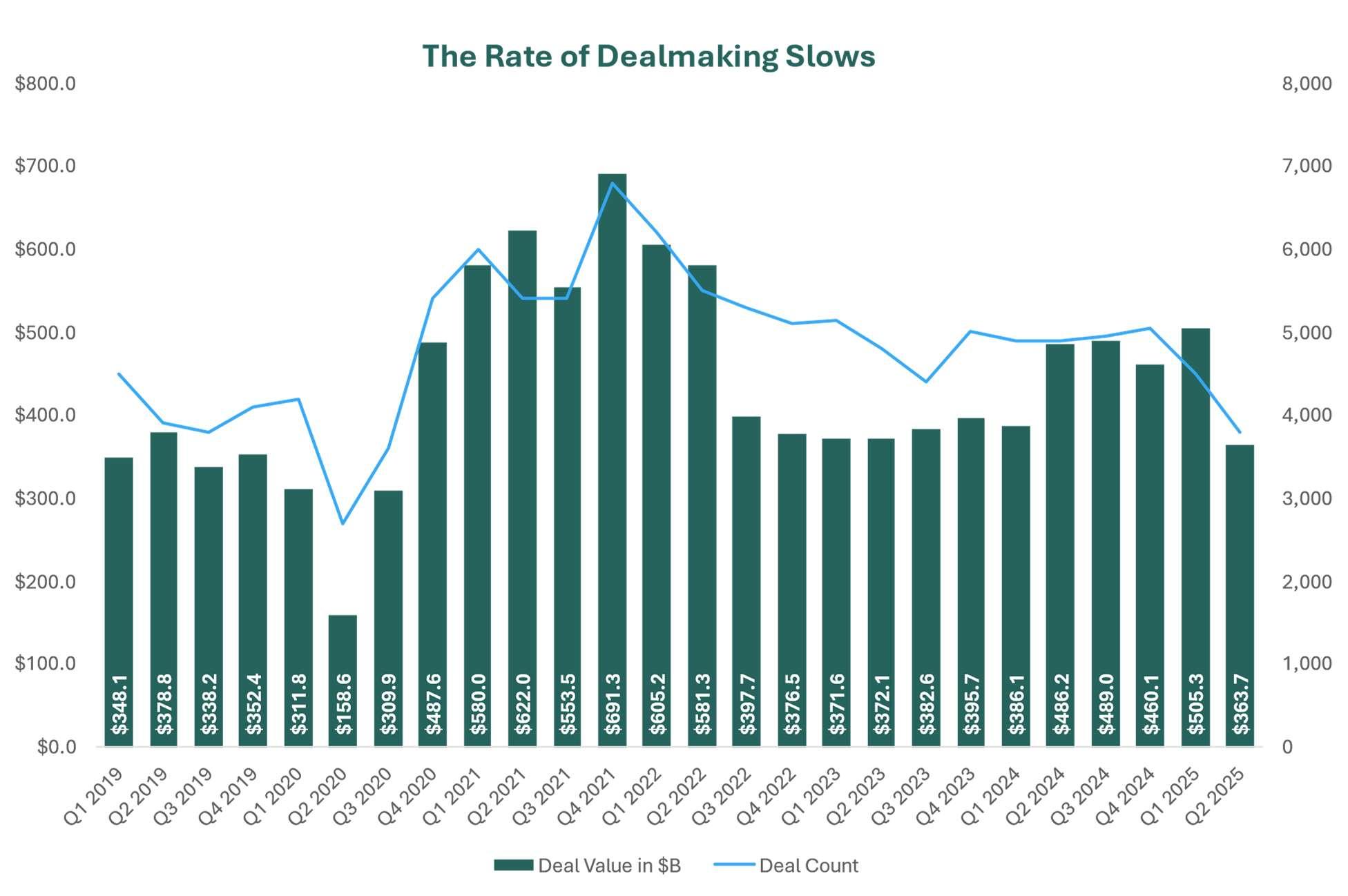

Private equity has entered a cautious phase in 2025. Tariffs and ongoing global trade uncertainties are not just abstract policy shifts – they directly shape how PE investors deploy capital and manage risk. Deal activity slowed sharply in Q2 2025, with investment dropping from $505.3 billion in Q1 to $363.7 billion in Q2. Even though a few mega-deals in the US dominated headlines, overall sentiment leaned conservatively.

For many investors, tariffs have disrupted confidence in global supply chains and cross-border strategies. Instead of pushing aggressively into international markets, PE firms are leaning towards regional bets – investing in businesses with stronger domestic or localized supply chains that are less exposed to tariff risks. Sectors like healthcare and biotechnology, with more regionalized demand, saw continued traction, while tariff-sensitive industries like automotive and manufacturing lost appeal.

Impact of Tariffs on Private Equity Strategy and Sectoral Focus

Tariffs are reshaping private equity by increasing operational costs for trade-dependent portfolio companies and introducing market volatility that complicates valuations and risk assessments. This has led to a strategic pivot from globalization to regionalization in dealmaking. Equity-focused firms face margin pressures due to import reliance, while investment-focused firms are shifting toward sectors less exposed to trade disruptions. As a result, interest is rising in healthcare, biotech, energy, and infrastructure, while manufacturing and automotive sectors are losing momentum.

-

Challenges faced by PE due to tariffs

- Exit Planning Challenges and Prolonged Holding Periods: Tariffs have added significant uncertainty to the exit environment, complicating sale processes and potentially lowering returns. Combined with broader macroeconomic headwinds, this has led to extended holding periods and intensified pressure on private equity firms to deliver timely capital returns to investors.

- Cost and Margin Pressures: Tariffs threaten to raise input costs and compress margins, reducing the competitiveness and profitability of portfolio companies – a direct hit to valuation and exit readiness.

- Limited Visibility into Indirect Exposure: Many firms lack insight into the inflationary impact from second – and third-tier suppliers, making it difficult to fully assess tariff-related risks and cost passthroughs.

- Delayed Strategic Investments: The uncertain duration and scope of tariffs have caused firms to postpone transformative supply chain changes and capital expenditures, slowing operational improvements.

-

Strategic Opportunities

Private equity firms are identifying several strategic opportunities to navigate tariff-related challenges. These include supporting portfolio companies in diversifying their supply chains by reassessing sourcing locations and implementing tariff engineering strategies such as dynamic pricing models or restructuring imports to reduce tariff burdens. Firms are also leveraging trade programs like free trade agreements and duty drawback schemes to manage or defer costs. Additionally, there is a growing focus on domestic and regionally oriented businesses that are less exposed to global trade risks, while selectively pursuing high-quality global investments that demonstrate resilience to tariff shocks.

Real Estate Market Transformation

The global real estate sector is being reshaped by protectionist trade policies and escalating tariffs, which have driven construction costs up by as much as 40% since 2020, pressuring margins and feasibility. In response, investor sentiment has turned cautious, with capital shifting away from politically volatile regions toward markets offering regulatory stability and resilience. Transaction activity has slowed, underwriting has become stricter, and defensive asset classes such as industrial and multifamily have gained traction, reflecting how policy volatility and geopolitical dynamics are now as influential as traditional economic fundamentals in shaping investment strategies.

Impact of Tariff on Real Estate Market

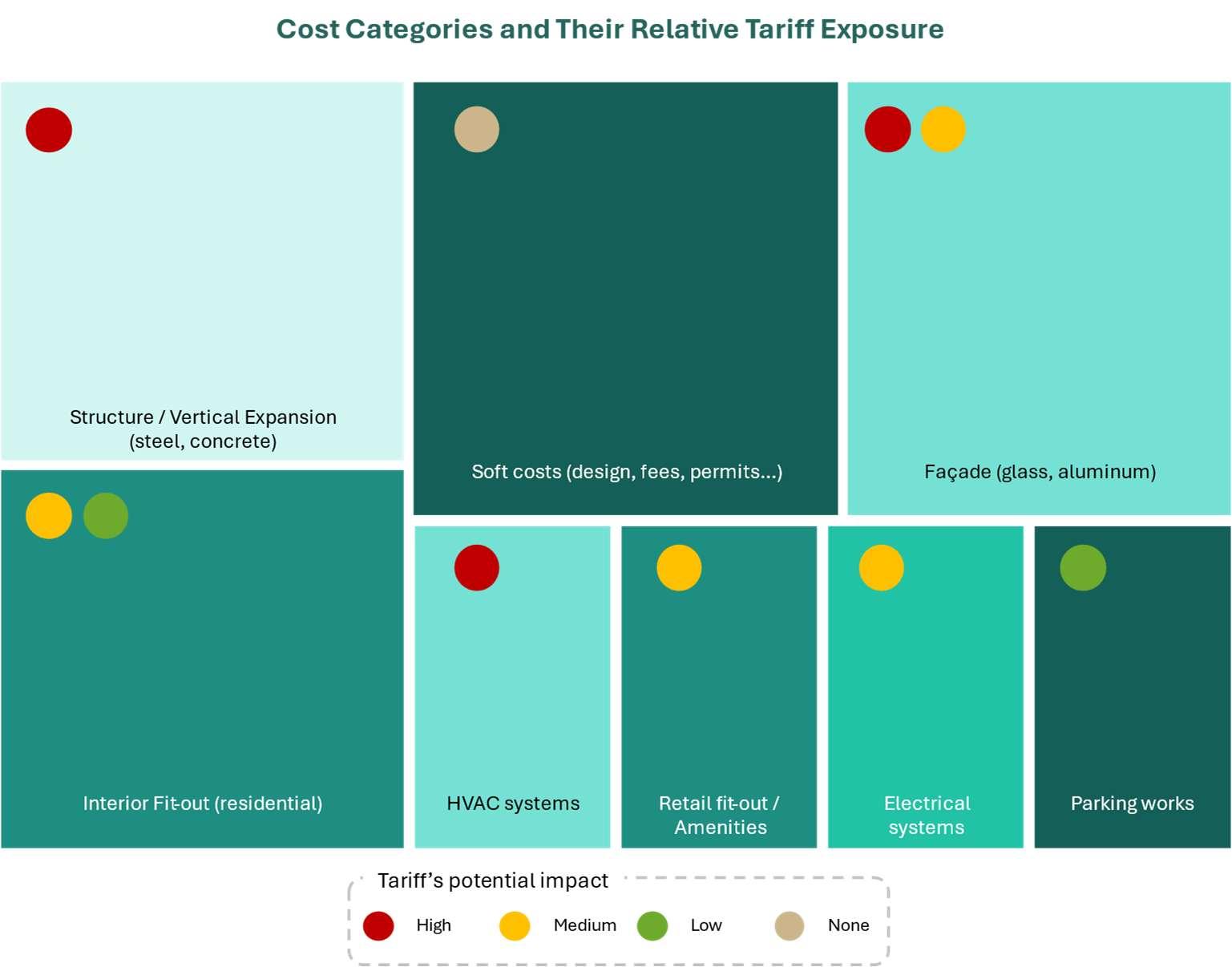

- Rising Construction Costs: Tariffs on key materials like steel, HVAC systems, and electrical components have inflated input costs by 4–10%, pushing total development costs up by 30-40% since 2020 across both residential and commercial sectors.

- Yield and Feasibility Challenges: Rental growth has lagged behind cost increases, compressing yields and making many projects financially unviable leading to delays, cancellations, or strategic pivots toward refurbishments and conversions.

- Sectoral Sensitivities: Multifamily housing remains resilient, while student and senior housing face higher tariff exposure. In commercial real estate, logistics and data centers maintain feasibility due to strong demand, whereas retail and office sectors are more cautious and selective.

- Strategic Investment Shifts: Developers and investors favor value-add strategies, renovations, and long-term lease assets (e.g., grocery-anchored retail, medical outpatient) over new builds to mitigate tariff risks and ensure stability.

-

Challenges faced by RE due to tariff

- Cost Escalation: Tariffs have significantly increased construction input costs. Inflation in materials like structural steel and electrical systems is outpacing rental growth.

- Financing Constraints: Interest rates remain elevated, tightening credit availability. Higher cost of capital is reducing acquisition and development activity.

- Capital Flight: Political uncertainty is driving capital out of U.S. gateway cities. Investors are reallocating to markets with greater policy and legal stability.

- Development Viability: Compressed margins and reduced yield on cost are making new projects economically unfeasible. Many developments are being shelved or delayed.

-

Strategic Opportunities

Real estate investors are pursuing strategic opportunities to manage policy and market volatility. Adaptive reuse-like converting offices to multifamily housing-offers cost efficiency and ESG benefits, especially with discounted land in prime locations. Portfolio engineering is now standard, with sectoral rotation and jurisdictional filtering helping absorb political risk. Capital is shifting toward stable regions such as Japan, Australia, Germany, and the Nordics, valued for legal certainty and ESG enforcement. Resilience is built into strategies through stress testing and scenario planning, while smart technologies and outsourced operations are boosting efficiency and scalability.

The Way Forward

-

Private Equity Investors

Private equity investors remain attentive to resilient, high-quality assets with structural growth potential, particularly in sectors like AI infrastructure, energy, and domestically anchored businesses. These areas continue to play a pivotal role in digital transformation and energy security. Monitoring macroeconomic signals from the US administration and the Federal Reserve is essential, as shifts in policy could influence market sentiment and deal flow. With growing momentum in AI-related infrastructures such as data centers and regional connectivity-investors can find value in region-specific opportunities that align with broader adoption trends. On the exit front, maintaining flexibility is crucial. While IPO activity in the US is showing signs of revival, dual-track strategies that combine IPOs with private sales may offer greater optionality and value capture. Strengthening operational capabilities and strategic positioning within portfolio companies can help enhance resilience, improve exit readiness, and increase appeal to potential buyers in a competitive investment environment.

-

Real Estate Investors

Real estate markets are seeing increased attention on obsolete office assets located in prime urban areas, particularly where pricing reflects significant discounts relative to land value. These properties often present a combination of downside protection and potential for conversion into residential formats that are in high demand. In many cases, repositioning strategies involve evaluating the feasibility of transforming such assets into Class A multifamily developments. Although these projects tend to be capital-intensive, they can generate long-term value through premium rents, stronger defensibility, and alignment with ESG-oriented investment themes-especially in markets with limited supply. Tariffs and rising construction costs continue to introduce volatility into development planning. In response, some projects incorporate structured ownership models, such as Guaranteed Maximum Price (GMP) contracts or pre-negotiated capital expenditure frameworks, to help manage financial risk. High-impact capital improvements-like vertical expansions, façade enhancements, and lifestyle-focused amenities such as rooftop pools or integrated retail-are also becoming more common. These features can improve a property’s competitiveness, attract premium tenants, accelerate lease-up timelines, and contribute to stronger asset valuations, supporting both near-term project feasibility and long-term resilience.

At Preferred Square, we partner with clients to navigate shifting market conditions and identify opportunities that align with long-term objectives. Our expertise in both private equity and real estate markets, combined with deep understanding of financial impacts, positions us to help clients capitalize on the opportunities created by today’s challenging investment environment. We provide customized solutions that address the unique needs of each client while maintaining focus on sustainable, long-term wealth creation strategies.

Leave a Reply