Feb 2024

Kingdom of Saudi Arabia’s real estate industry is thriving, fueled by Vision 2030 and transformative GIGA projects such as NEOM. The government aims to further accelerate this growth by increasing homeownership to 70% by 2030, up from the 47% in 2016.

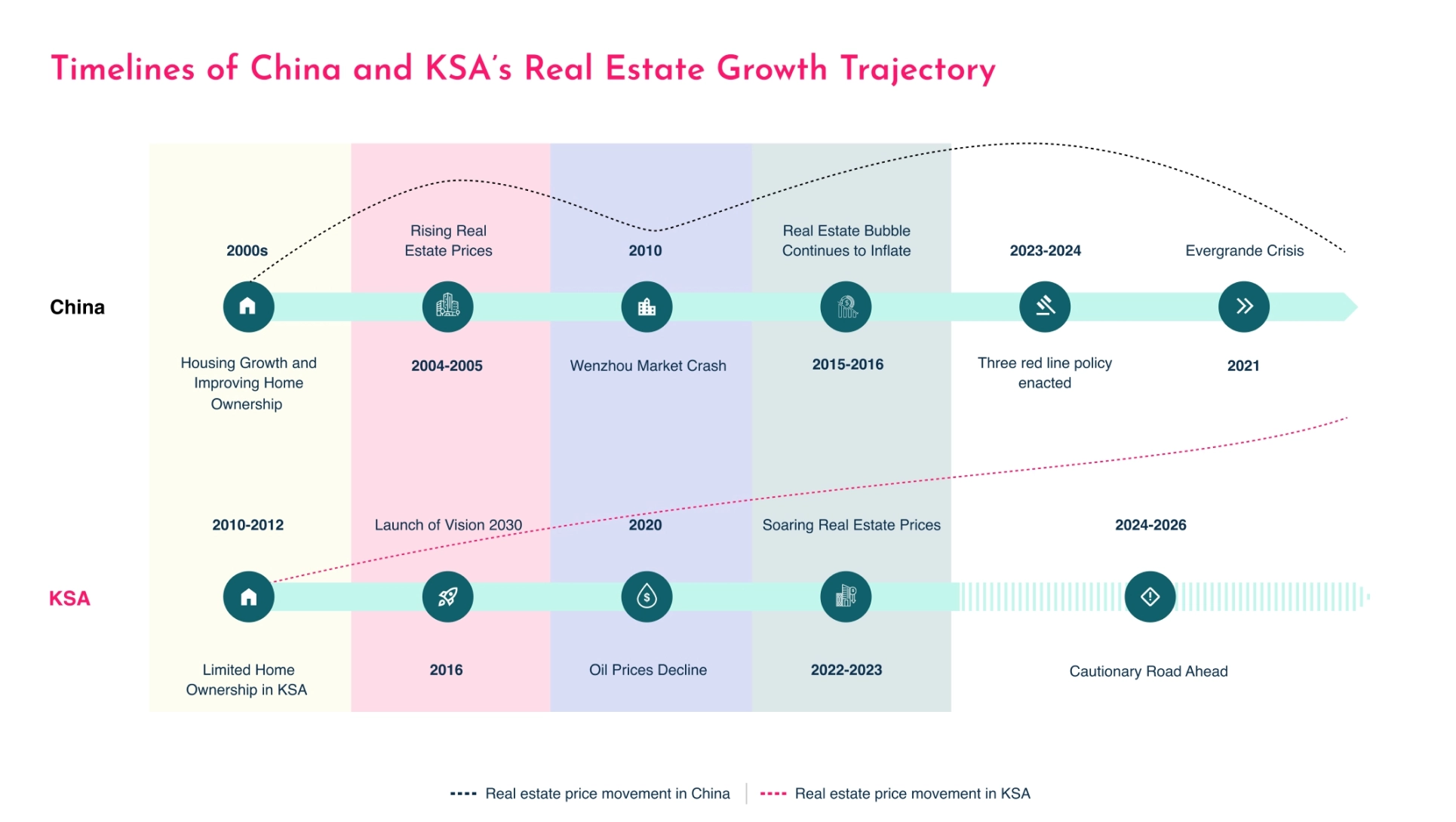

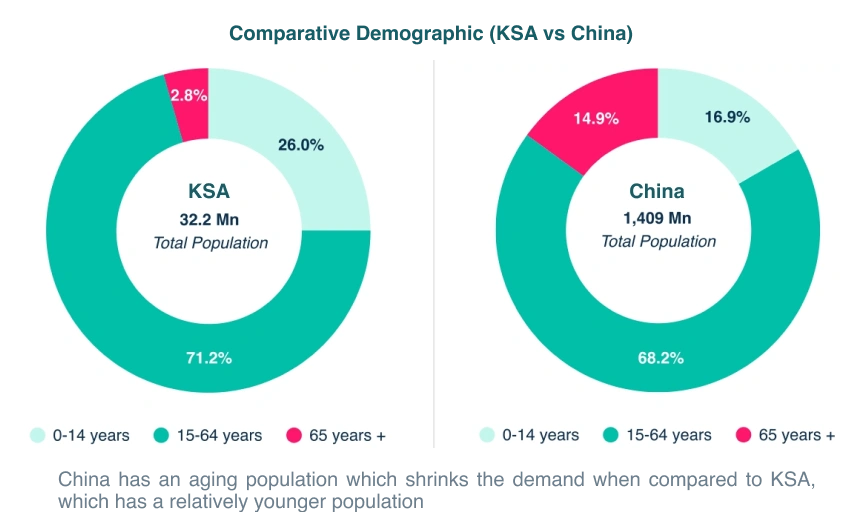

China underwent a comparable period of growth characterized by a housing boom in the 2000s. However, as of 2023, the country is combating a real estate crisis. As we draw a parallel between China’s and KSA’s real estate industry, concerning resemblances surface, such as lack of government intervention, high reliance on real estate, and expansion in remote areas. As a result, we foresee a potential housing bubble forming in KSA if cautionary measures are not taken in time.

This report identifies and examines the parallels and distinctions between the real estate industries of KSA and China. It also offers strategic recommendations for KSA to prevent a potential housing bubble, aligning with the ambitious goals of Vision 2030.

Key measures that KSA can take to mitigate a potential housing bubble:

- Prioritizing Risk Management: China’s experience highlights the importance of closely monitoring debt levels, fostering responsible lending practices, and curbing excessive speculation. KSA can mitigate potential systemic risks and promote long-term market stability by implementing robust monitoring systems and enacting prudent regulations.

- Implementing Effective Regulations: KSA should enact policies that increase data availability and access, empowering informed decision-making for all stakeholders. Additionally, targeted measures to control real estate prices and prevent overheating can safeguard against future bubbles.

- Empowering Individuals Through Financial Education: Financial literacy equips individuals with the tools to make responsible investment choices. By learning from China’s real estate trajectory, KSA can emphasize responsible financial decision-making, reducing the likelihood of similar crises in the future.

- Building Financial Resilience: Establishing mechanisms for prompt intervention in cases of financial distress among developers is crucial. This ensures financial stability within the sector and protects against cascading effects on the broader economy.

- Encouraging Balanced Regional Development: Concentrated development can lead to bubbles. KSA should prioritize a geographically balanced approach to real estate development, mitigating risks and fostering broader economic growth.

- Promoting Long-Term Investment: Implementing or adjusting real estate taxes, like capital gains or holding taxes, can discourage speculation and encourage long-term investment. This fosters a more sustainable and balanced market. With the aim of reducing the tax burden on the real estate industry, a Royal Decree was issued on 1 October 2020. This created a Real Estate Transaction Tax (RETT) with a rate of 5% VAT on real estate transactions, replacing the previous 15% tax.

- Cultivating a Diverse Market: Promoting the development of affordable luxury housing expands the market and caters to a growing population segment. Incentives or subsidies for private sector involvement in this segment (SAR 1.5 million – SAR 6 million price range) can accelerate its growth and contribute to a balanced market.

- Urban Planning: Learning from China’s urban development challenges, KSA can prioritize effective urban planning to prevent overbuilding and ghost towns. Sustainable urban development can contribute to a more stable real estate industry.

Read our findings on the real estate industry in KSA and the potential strategic measures to mitigate future risks.

Leave a Reply